We are thrilled to announce the debut of VIBES, our experimental creator-focused layer 3 blockchain, crafted with Caldera technology and fully integrated with Thirdweb and Reservoir. The launch of our testnet is exploring a state-of-the-art infrastructure that ingrains royalty mechanisms at its very foundation.

Imagine an EVM-compatible blockchain and an exceptional node-level royalty framework. This forward-thinking model bypasses the limitations of standard smart contracts and enables creators to set their royalty terms with confidence.

The Thirdweb integration covers wallet interfaces and contract management to payment processing. Reservoir integration powers our NFT aggregator tech stack.

Designed with the interests of creators, curators, and collectors in mind, the testnet can enable economical minting, buying, and trading of NFTs, with the added convenience of making transactions in ETH, USDC, or directly using a credit card in USD. Potentially achieving block confirmations in as little as 250 milliseconds and supporting a transaction rate of 200-500 per second, ensuring quick and secure transactions that are on par with the security standards of Ethereum’s blockchain.

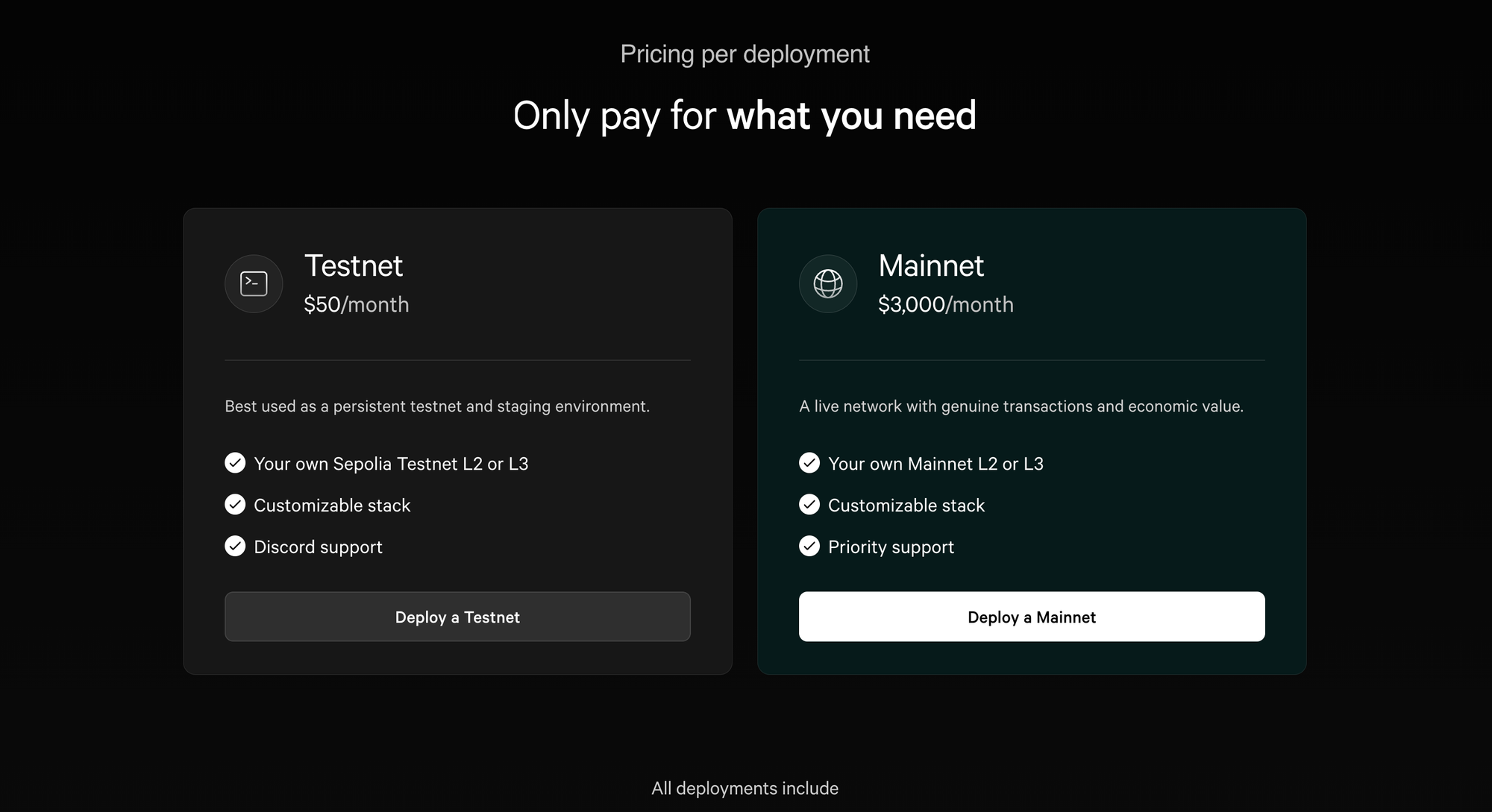

A year has passed since we launched a rollup with Conduit, and it's time to evaluate its integration with the ecosystems of Reservoir and Thirdweb, akin to our experiences with Caldera.

The escalating expenses associated with Ethereum Layer 1 have underscored a critical need for change, fostering wider crypto adoption. In this landscape, Conduit has been a game-changer, offering on-chain entities like DeFi platforms, NFT marketplaces, and on-chain art galleries a viable solution to scale.

Deploying a rollup offers several strategic advantages. It prevents unexpected gas fee spikes, ensuring consistent, low-cost transaction processing even during high-demand periods elsewhere. Possessing a private rollup allows for the development of more sophisticated, gas-intensive apps. Owning a rollup presents a lucrative opportunity through sequencer fees. By charging a premium over the base cost required for transaction settlement on the underlying layer, we can tap into a continuous revenue stream that grows with our transaction volume.

Conduit's advent was a boon for entities eager to deploy their rollups, transforming a potentially half-year-long journey of development, staffing, and maintenance into a streamlined, managed rollup solution. This innovation not only accelerates the path to production but also democratizes the ability to launch specialized rollups. Backed by a team of seasoned experts from Instagram and Meta, Conduit stands at the vanguard of this rollup era. (OP Stack = modular, EVM-compatible)

Avenues for shared sequencer fees and Maximal Extractable Value (MEV), proposing a sustainable economic model

Over 2 years ago we deployed our local blockchain with Polaris, today we are playing on testnet with Rollkit Wen 420

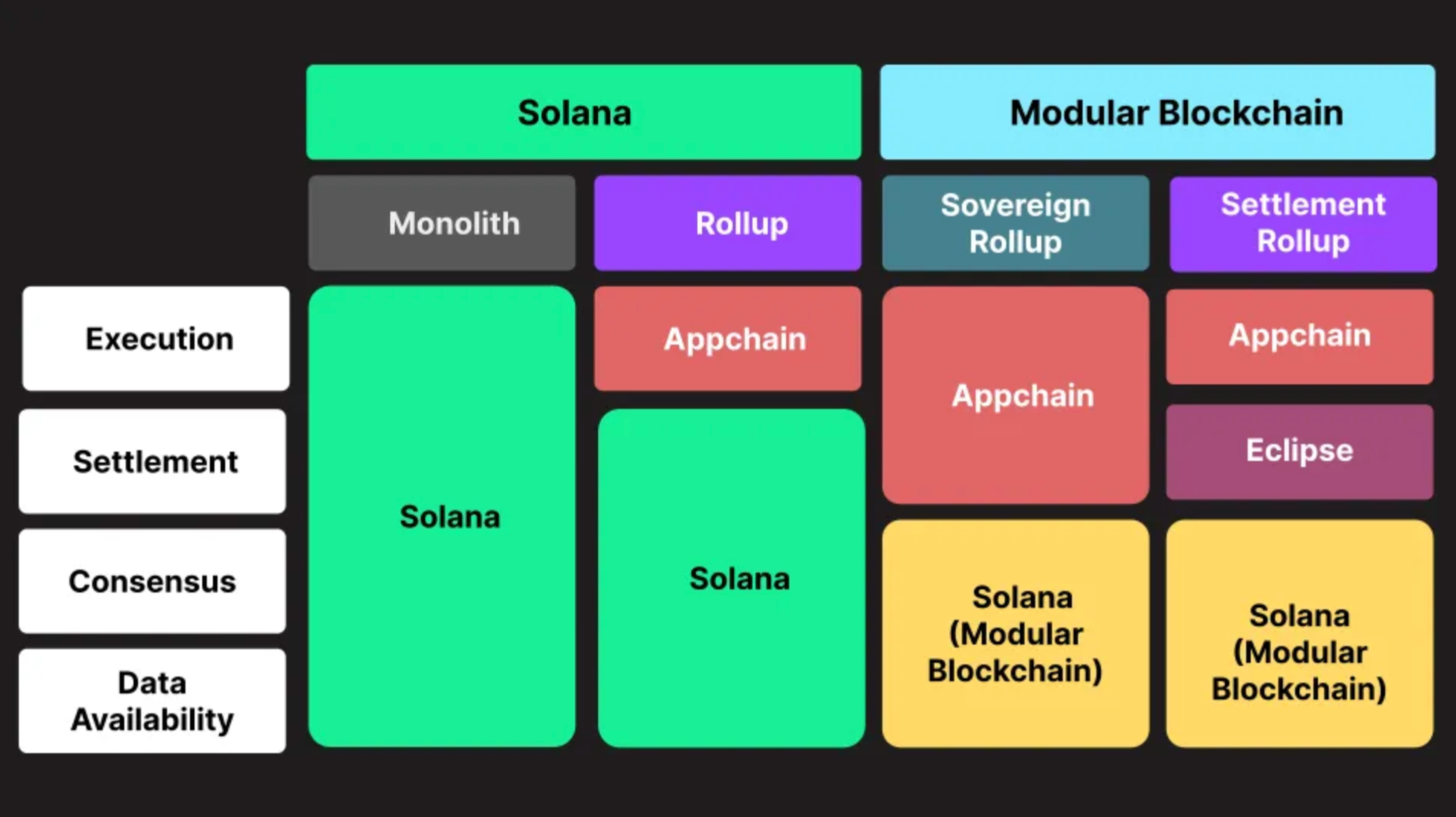

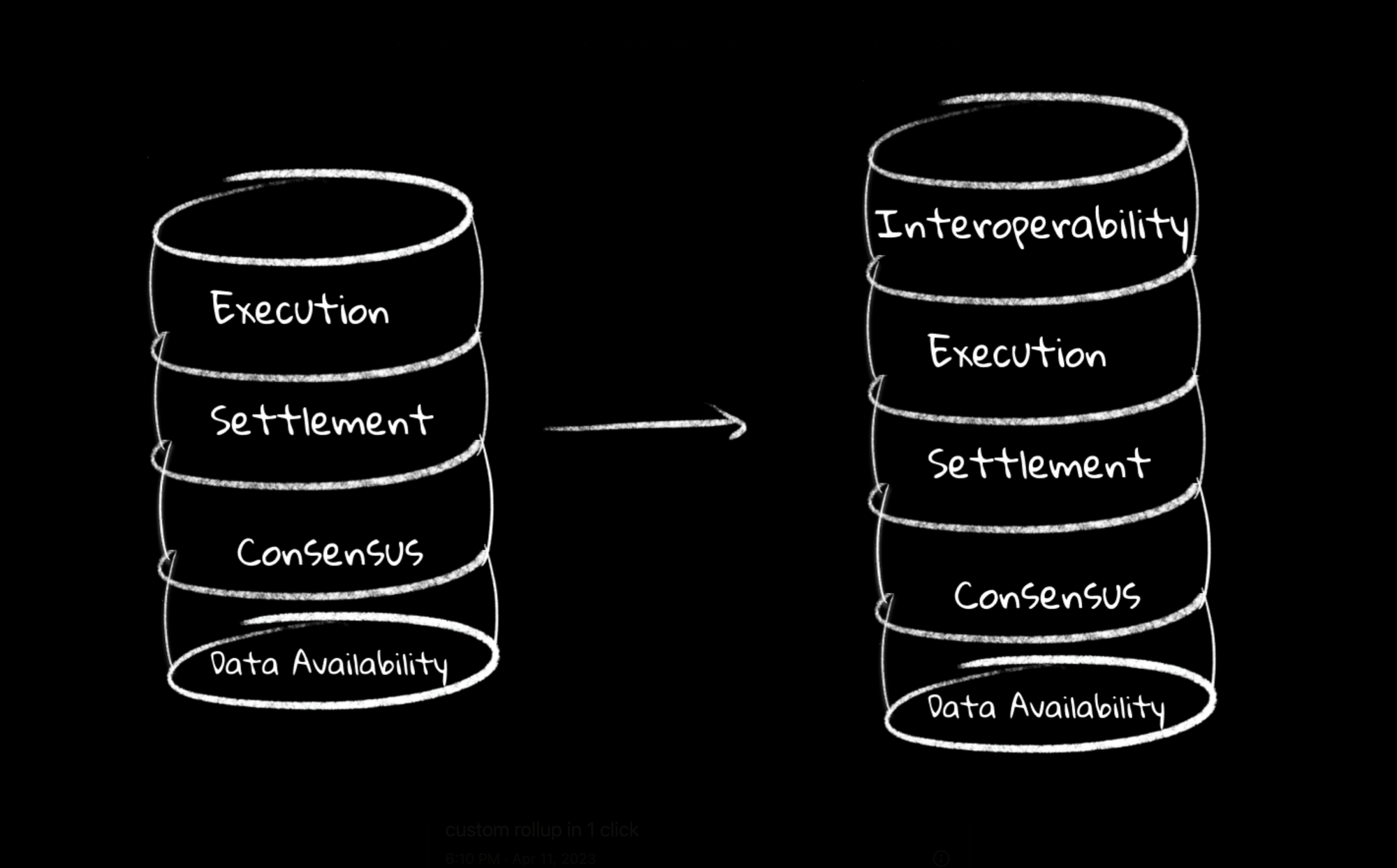

We’re entering an era where blockchains/rollups will be as easy to customize and launch as a Squarespace website. Modular frameworks like Cosmos SDK, Celestia Rollkit, OP Stack, plus providers like Conduit, Eclipse, and especially Caldera are leading the way in streamlining the blockchain/rollup launch experience.

Dymension

A specialized rollup that facilitates off-chain transaction processing and is governed by an individual sequencer (or a consortium). The Dymension Hub functions as the settlement layer. It coordinates with Dymint, Dymension's bespoke adaptation of the Cosmos Tendermint consensus algorithm, to construct blocks dedicated to RollApps. Notably, it generates blocks on an as-needed basis, which is a resource-efficient approach unlike the constant block production seen in other blockchain frameworks. Additionally, it serves as a nexus, connecting various RollApps to enable intercommunication, bridging, and asset exchange.

The RollApp Development Kit (RDK) is akin to the Cosmos SDK and is designed for crafting and deploying RollApps without requiring permission. It incorporates modules from various technologies including the Cosmos SDK, the Inter-Blockchain Communication (IBC) Protocol, Ethermint, and CosmWasm. These integrations provide RollApps with essential tools for governance, token transfers, updates, and support for EVM and CosmWasm smart contracts.

RollApps inherit the Hub's security attributes, can utilize Dymension's validator network (thus avoiding the initial challenge of attracting validators and preventing token inflation), and can concentrate on optimizing transaction throughput and latency since they do not need to handle consensus. The Hub’s native Automated Market Maker (AMM) also allows RollApps to pool liquidity, helping to solve the common Layer 2 challenge of liquidity fragmentation and enabling them to collect transaction fees in their chosen token. To boost engagement, Dymension has also introduced an incentive scheme for their AMM, providing attractive APRs for participants in certain liquidity pools.

GMonad

Monad is a high-performance Ethereum-compatible L1, with throughput of 10,000 transactions per second (tps). Monad brings technical enhancements like deferred execution, Monad Custom Database, and parallelization. It has a significant opportunity to showcase the importance of scalable Layer 1 solutions to the Ethereum community. It seems like a nice balance between the technical advantages offered by Solana and the familiarity and simplicity of the EVM.

Meet Eclipse & Celestia.

Eclipse represents an innovative endeavor, crafting the inaugural Sealevel VM rollup that introduces a Rollup-as-a-Service platform with a modifiable foundation. This initiative is set to launch an IBC-compatible rollup utilizing Celestia as its underlying data availability framework. At its core, Eclipse is a refined adaptation of Solana’s codebase, reimagined to embrace a modular architecture.

Hyperlane is optimized to be permissionlessly deployed to any Solana-VM rollup, especially Eclipse rollups.

Its operation is straightforward—Eclipse enables the creation of bespoke modular rollups powered by the robust Sealevel virtual machine, facilitating the execution of programs initially designed for Solana.

However, Eclipse diverges from relying on Solana for its security infrastructure. Instead, it offers flexibility in the base layer's configuration, allowing choices among CelestiaOrg, Polygon Avail, or Eigen Layer to tailor the foundational security and functionality to specific requirements.

The interoperability between Solana and Ethereum is becoming increasingly crucial as the blockchain sector evolves, addressing the limitations and strengths of both platforms. Ethereum is renowned for its comprehensive smart contract capabilities and developer ecosystem but is hindered by low transaction throughput and high costs. To counter these issues, Ethereum has explored Layer 2 solutions, but these have not fully resolved the core challenges.

Solana, with its high-speed, cost-efficient transaction framework, presents a compelling alternative, especially for applications requiring rapid and economical transaction processing. It has outpaced other Layer 1 blockchains in transaction volume as of the second quarter of 2023, signifying its growing prominence.

The blockchain community has historically been segmented, with dApps typically confined to a single blockchain, limiting their user base and functionality. The development of interoperability solutions like Neon EVM and Solang is a significant stride towards bridging this divide, enabling the seamless integration of Ethereum's Solidity-based dApps within Solana's ecosystem.

Neon EVM offers an Ethereum-compatible environment on Solana, allowing Ethereum dApps to operate as native EVM applications on Solana, thereby leveraging its efficiency and lower transaction costs. It maintains Ethereum's operational familiarity while integrating Solana's benefits, supporting popular Ethereum toolchains and wallets.

Creating a new blockchain is akin to forming a new habitable world. What's the point of having such a world if it's inaccessible? And what are the chances of fostering a thriving community if your isolated world lacks connections to established ones? Initially, a handful might venture with you to this uncharted territory, but without a reliable return route, it's a high-stakes gamble.

In the realm of permissioned interoperability, as the creator of the blockchain or the pioneer of the planet, you must persuade an interoperability protocol to accommodate your creation. This leaves you vulnerable, confined to slow progress while you await approval, or facing a nonstarter if denied.

However, the emergence of Permissionless Interoperability transforms the landscape. It liberates you from relying on the favor of existing interoperability frameworks. With tools like Hyperlane’s Permissionless Interoperability, you're empowered to initiate and control connections between your new world and others at your discretion. This autonomy ensures you can establish and maintain prosperous trade channels with any world you choose, on your terms.

Ikigai Labs XYZ can now use Hyperlane APIs to compose with apps on other chains, accessing external liquidity and simplifying the user experience.

Rollups' Commitment to Ethereum

Currently, rollups contribute approximately $30 million per month (or around 12,000 ETH) in fees for publishing data to Layer 1 (L1), accounting for about 15% of total fees paid on the Ethereum network. As new rollups are introduced, they start to publish blocks on Ethereum, incurring costs for data publication irrespective of their transaction volume.

- Zero-Knowledge Ethereum Virtual Machines (zkEVMs) tend to have a more fixed cost for data publication, suggesting a constant-size scaling model.

- Optimistic rollups typically exhibit a variable cost structure, indicating a linear scaling model.

In this context, Ethereum acts as a supplier to the rollups. Regardless of the payment structure (fixed or variable costs), Ethereum's L1 can be viewed as a prioritized creditor to the L2 rollup operators (nodes).

In scenarios of low transaction volumes, where L2 fees don't cover the rollup's operating costs, operators must continue funding data publication. Consequently, operators might need subsidies from foundation treasuries or direct block subsidies, likely sourced from L2 token emissions or grants. Hence, L2 tokens serve as a financial safety net for settling debts to L1 for its services.

If L2s struggle to fulfill their ongoing commitments to Ethereum, they face several choices:

- Reduce profit margins (current rollup operator margins are around 25%).

- Change data suppliers (switching from Ethereum for data availability).

- "Default" on L1 consensus (ceasing chain operations by not publishing data).

Regarding EIP-4844, it's akin to launching a new factory that specifically caters to L2 clients with a novel data publishing solution. It introduces a unique data type and pricing model aimed at reducing data publishing expenses. Essentially, the Ethereum Foundation (EF) is preempting competitors by offering a more affordable data supply, reminiscent of inaugurating a mega-factory for data.

Summary of EIP-4844 highlights:

- Introduces a new data format ("blobs").

- Charges 3 gas per byte compared to the current 16 gas per byte.

- Erases blob data after several weeks.

However, the lower gas cost per byte with 4844 doesn't guarantee a fivefold reduction in expenses. The introduction of a new gas market means that, despite lower data costs, the gas price might increase.

Long-term saturation of the 4844 market could equalize its pricing with existing data costs. Analogously, if Ethereum represents a highway and rollups are buses on this highway, then 4844 symbolizes a dedicated bus lane that could still experience congestion, potentially mirroring the throughput of regular lanes.

The launch of 4844 could initially decrease Ethereum's data publishing costs, enticing more rollups to enter long-term commitments. This scenario can be seen as a temporary promotional period, after which there's substantial technical and social inertia against departing from Ethereum.

The revised approach towards a rollup-centric roadmap and scalable solutions has substantial benefits for ETH:

- L2s are bound by a continuous commitment to L1, with L2 token holders providing financial support.

- ETH holds a position of ultimate financial priority, being the first to receive payments.

- L2 operators must ensure their capacity to meet financial commitments, or L2 token holders will need to contribute more through additional token issuance.

- The introduction of 4844 is poised to draw numerous new L2s into a lifelong commitment to Ethereum, representing highly valuable long-term clients.

L2s are essentially entering a long-term commitment with Ethereum, backed by their token issuance, ensuring Ethereum's seniority in financial matters. The strategic move benefits Ethereum, securing its position and potentially attracting a lifetime commitment from new L2 projects.