Baseline transcends traditional tokenomics, offering an ingenious engine tailored for ERC20 tokens that melds a dynamic supply framework with an elementary market-making blueprint. This innovation bestows upon emerging ERC20s perpetual on-chain liquidity and immutable leverage, right from inception.

With each Baseline token deployment, there's an automatic endowment of initial liquidity into a Uniswap V3 pool. From the get-go, the entire token supply is retained on-chain under the protocol’s aegis, ensuring perpetual value protection.

ETH backed ohm with dynamic RBS? OHM without the rebases and cooler loans live at launch? (YES, YES) 🔥

Perpetual Value

Baseline pledges an unwavering "baseline value" (BLV) for ERC20s, safeguarding enough liquidity to potentially repurchase their entire circulation. Essentially, the BLV symbolizes the ultimate redemption price within the pool.

This feat is attainable as the protocol exclusively holds the initial supply, precluding premature allocations to teams or investors. Each Baseline token emerges directly from the pool, thereby fortifying liquidity cumulatively.

Such liquidity then empowers Baseline's permissionless market-making framework and its inherent credit facility, both orchestrated to perpetually elevate a Baseline token’s BLV. These mechanisms are ingeniously crafted to ensure the BLV’s relentless ascent, heralding an era of ever-rising token valuations.

Market Making

Baseline’s market-making ethos incrementally amplifies the token's intrinsic value through calculated liquidity maneuvers. It allows open-ended rebalancing of protocol-controlled liquidity, maintaining a triad of Uniswap V3 stances, thus ensuring an equitable, foreseeable, and transparent marketplace.

The protocol’s credit apparatus enables instant valorization of the token’s BLV, permitting users to leverage liquidity assets straight from the Uniswap pool, sans the need to liquidate their holdings. This structure is impeccably designed to preserve the protocol's fiscal health, immune to the vicissitudes of market liquidations.

Revenue Growth

Baseline's revenue streams flow from LP fees in Uniswap V3 pools, liquidity rebalancing, and borrowing charges, all funneling towards the BLV’s augmentation.

Upon deployment, Baseline tokens enrich the pool with liquidity synonymous with the Fair Delivery Value (FDV), facilitating substantial transactions. It promises an inherent BLV, bolstered over time by its market-making schema and credit facility, ensuring a fertile ground for token valuation growth.

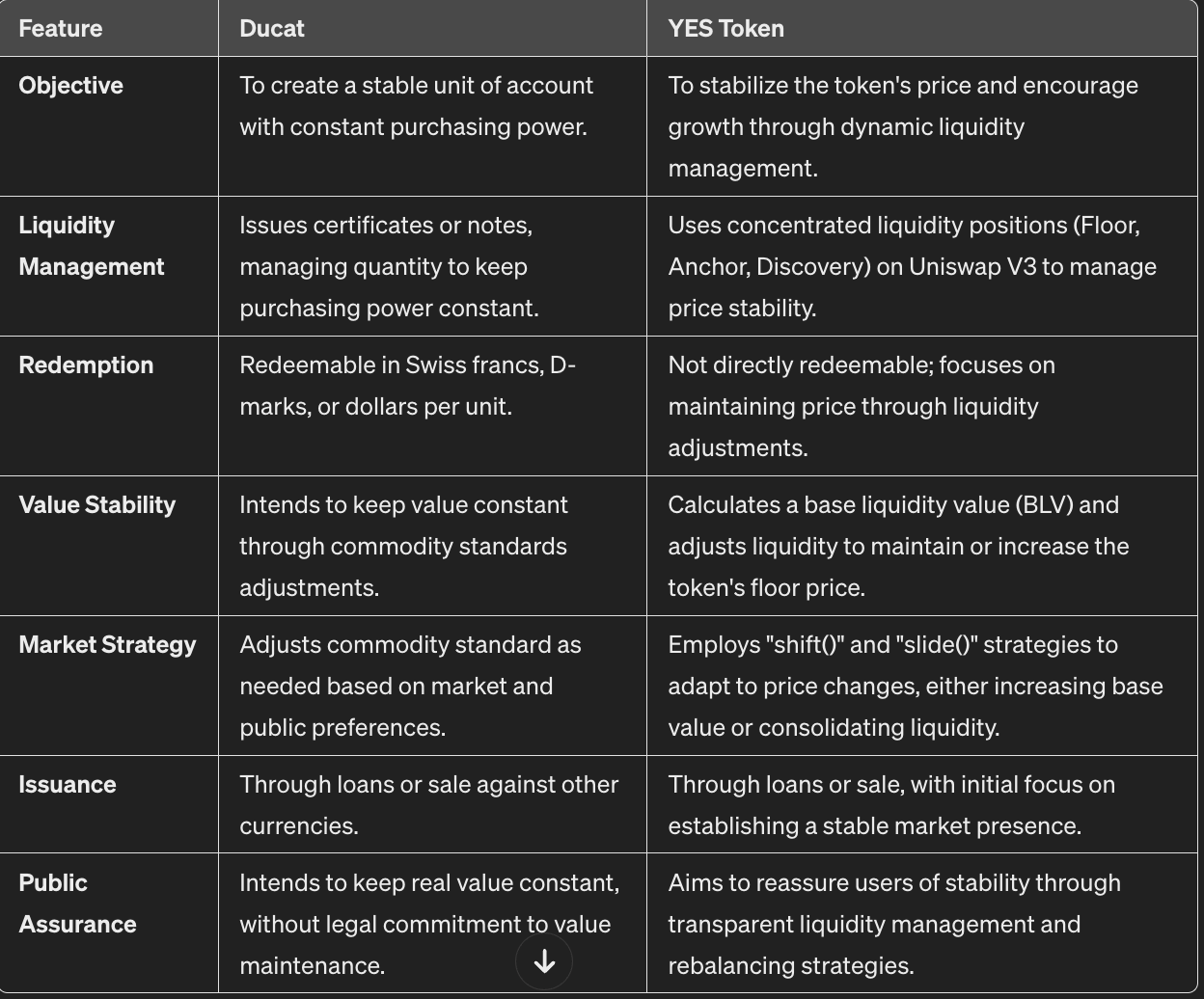

The protocol’s market-making stratagem unfolds across three liquidity echelons—Floor, Anchor, and Discovery—each designed to optimize the token’s valuation and market stature.

- Floor: Tight range liquidity to defend the token's BLV

- Anchor: Wide range liquidity to allow for a premium

- Discovery: Thick liquidity to allow for high-volume trades

Degen Vibes

Leverage Baseline tokens as collateral to unlock assets, tapping into the protocol's assured token valuation. This enables a spectrum of sophisticated, leveraged financial endeavors without the specter of liquidation, embodying the avant-garde of financial prudence and innovation.

This revolutionary "Up Only Technology," may or may not redefine the paradigms of tokenomics and on-chain liquidity for the enlightened crypto connoisseur.

Baseline automates liquidity management for tokens, particularly on V3 Automated Market Makers (AMMs).

It introduces a novel approach to token launches, offering single-sided liquidity and avoiding the traditional method of taxing buys and sells. Instead, Baseline manipulates liquidity depth between specific price ranges (ticks) to accrue fees in ETH, creating a more seamless trading experience.

The protocol establishes a price floor for the token through its unique 'floor' and 'anchor' ticks system. This floor is bolstered by the fees collected from trading activity, ensuring that the token price cannot fall below this level. The liquidity is dynamically adjusted through 'shift' and 'slide' functions in response to price changes, ensuring optimal balance and enhancing the token's stability.

An intriguing aspect of Baseline is its ability to offer native leverage without the risk of liquidation, by locking up tokens and borrowing against the floor price. This ensures a solvent position regardless of market conditions, with the potential to adjust leverage as the floor price rises.

Despite its promise of an 'up-only' market condition, risks remain, especially when the token trades at a high premium above the floor price. Nonetheless, buying near the floor price significantly caps the downside risk.

The suggestion for future implementations includes thinning out liquidity in the price discovery zone to enhance price sensitivity and potentially accelerate upward price movements, while still leveraging the protective mechanism of the floor bins.

Overall, Baseline presents a forward-thinking mechanism in the realm of protocol-owned liquidity, marrying innovative fee accrual and liquidity management strategies with robust protective features for token pricing.

Unencumbered by the legacies and setbacks that once overshadowed our collective aspirations. No DAO needed.

Allow me to share a personal reflection on my experience with OHM, a journey that spanned 3.3 years and involved a significant commitment of providing 3.3 million in exit liquidity. My profound disappointment stems from the divergence between the project's initial vision and its execution. The potential was immense, with a $690M+ treasury robust enough to pivot towards purchasing triple-digit ETH, thereby anchoring the protocol's value in Ethereum. Yet, this strategic shift towards an ETH-backed system never materialized. Moreover, the subsequent period highlighted critical vulnerabilities within Olympus, most notably during the bank run and the ensuing cascading liquidations. These events not only eroded the protocol's financial stability but also inflicted irreparable damage to its reputation. In contrast, the introduction of a new initiative, symbolized by "YES," represents a pivotal departure from the past, untainted by previous market histories. #BackedByETHnotDAI #NFA

Take Note: The ven diagram of YES & OHM is a full circle. I do somewhat agree with Smokey who said on X that talking about the overlap may not be good for the YES brand, but it's so obvious that it would be intellectually dishonest not to mention it. In any case, the upside here IMO is the experimentation, and having the gigabrains obsessing over the game theory and economic model, probably bullish tbh

Straightforward illustration

"Initially, the treasury holds $1000, and there are 100 tokens in circulation, with each token priced at $20. The base level value (BLV) is calculated as $1000 divided by 100, resulting in $10 per token. Now, when a user purchases a token from the protocol at $20, the new treasury balance becomes $1020, and the total number of tokens is 101. The updated BLV is $1020 divided by 101, equating to $10.10. This purchase effectively raises the BLV by 1% for all token holders. Interestingly, the protocol permits you to borrow the entire BLV almost for free, which is quite amusing. Yes, in this context, BLV is synonymous with RFV." - Yes x DCFgod

Summary

The protocol strategically manages liquidity to establish specific trading ranges, namely "Floor," "Anchor," and "Discovery." Let's delve into each one:

Floor: This represents the lowest possible price for the asset, essentially a fixed point rather than a range. It acts as a substantial liquidity reserve capable of absorbing the total supply. The Floor is static but can ascend under particular conditions, which we'll explore later.

Anchor: Serving as the core trading zone, the Anchor has a balanced liquidity level, allowing for more fluid price movements. Although theoretically distanced from Discovery, the Anchor's price typically remains close, adjusting downwards through a mechanism called Slide when necessary, thereby reducing its distance from Discovery.

Discovery: Positioned as the uppermost trading band, breaking through Discovery is essential for uplifting the entire price structure, including the Floor. It's heavily fortified with liquidity, demanding significant capital, approximately 500k, to alter the price by 1%. Surpassing this zone by 6% triggers an upward adjustment of all trading bands, positioning the price back within the Anchor range.

The rationale behind the substantial liquidity in Discovery is to ensure the protocol can increment the Floor securely by assimilating ample liquidity, thereby enabling consistent upward price momentum. This process requires significant capital inflow, surpassing what's typical for a meme coin, thus aligning more with a stablecoin's functionality.

Considering its mechanics, the asset, dubbed YES, has potential as a decentralized stablecoin, akin to a next-gen OHM. A strategic pivot could involve integrating YES within other protocols as a trading pair or treasury asset, thanks to its inherent stability and decentralized nature.

Furthermore, the protocol cleverly utilizes the Floor's liquidity as a collateralized lending facility, allowing YES holders to secure non-liquidatable loans, generating a sustainable revenue stream for the protocol beyond trading fees.

This innovative liquidity structure also informs specific trading strategies, emphasizing buying near the Floor or the Discovery threshold and selling prior to re-entering the Anchor, aligning with the protocol's liquidity dynamics.

(All strategies mentioned are not financial advice.)

/// BLAST BRIDGE /// SWAP /// LOOPING /// DOCS /// DEXSCREENER /// YT /// SIMUL ///