Bitcoin Income • Options Strategy • Monthly Distributions

MSTY Trading

Yieldmax MSTR Option Income Strategy ETF

I've got a question for you.

Why would you leverage trade, risk your sanity over red candles, or bet the house on a 20% pump when one wrong move could nuke your account?

MSTY gets all the hate, but it pays you every single month.

No stress. No price alerts. No 3AM panic sweats. Just dividends, dropping like clockwork. Gone are the days of chasing pumps and praying for "God candles." All you need to do? Absolutely nothing.

And let's be honest—to those complaining about NAV erosion? You're weak.

Think about it. With MSTY, you're trading countless emotional breakdowns, failed entries, and margin calls for a tiny NAV dip and a guaranteed payout. That's not erosion. That's evolution.

Quiet wealth wins.

MSTY isn't for hype chasers. It's for being smarter—with your time, your capital, and your peace of mind. It doesn't promise the moon, but it quietly pays for your life while others are still gambling on the next shitcoin.

An Alternative View: The BTC-Native Solution

🚀 Sell a fraction of BTC per month.

Zero mental gymnastics. No NAV decay, no ROC games, no options drag. No risk of underperformance from 3rd-party wrappers.

If your BTC grows more than you sell, you're drawing far less than your stack appreciates—your net worth still compounds.

Why This Wins

| Strategy | Complexity | Capital Preservation | Wealth Compounding | Liquidity | Tax Simplicity |

|---|---|---|---|---|---|

| Yield ETFs (PLTY, NVDY, MSTY) | High | Low (NAV decay) | Weak | Good (monthly) | Messy (ROC) |

| BTC-only (Sell fraction/month) | Low | High | Strong | Perfect | Simple |

Why Avoid Yield ETFs (For Now)

- 🛑 NAV bleeds slowly while giving the illusion of high income.

- 🛑 Most of the "yield" is just selling your own capital back to you.

- 🛑 Total return trails BTC long-term, especially post-halving.

- 🛑 These are not wealth boosters, just yield wrappers for traders.

Final Verdict

Keep stacking sats.

Sell a small fraction monthly.

Sleep easy. Skip the noise.

You're already holding the alpha asset. No need to wrap it.

Pushback: The MSTY Mirage

MSTY dangles a shiny 89% yield to bait yield chasers—but peel back the layers and you'll find one of the clearest examples of financial engineering dressed up as passive income.

Here's what it's actually doing under the hood:

- • Synthetic long exposure to MSTR (via long calls + short puts)

- • Short-dated covered call selling (OTM, <1-month expiry)

- • T-bills on the side to look "conservative"

But here's the kicker:

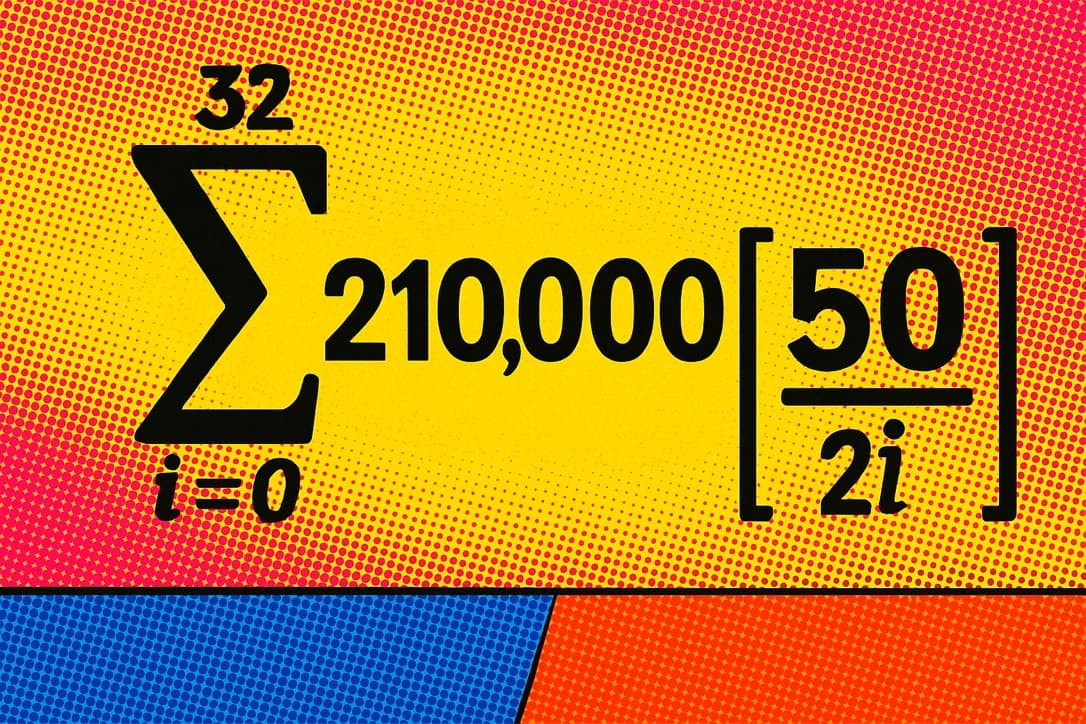

Over half of MSTYs distributions are just giving your own money back. Literally. Since inception, ~55% of payouts have been return of capital—not yield, not option premiums, just principal repackaged as "dividends."

Latest distribution breakdown (07/07/2025):

- • 96.86% return of capital

- • 3.14% actual income

🚨 ALWAYS READ THE FINE PRINT

MSTY advertises a 75% yield, but the reality is that 96.86% of your "dividend" is just getting your own money back. You're paying taxes on money that was already yours.

So unless you bought in early and got lucky with entry price, you're not compounding—you're eroding.

📉The Strategy Is Breaking Down

Why? Because MSTR volatility has collapsed in 2025. Option premiums—the core income engine—are drying up. So MSTY keeps faking the yield by returning capital.

Meanwhile, MSTR ripped +500% in Q4 2024, and MSTY? It caught crumbs. It's supposed to be a leveraged proxy. Instead, it's a neutered echo.

And now? It's underperforming both MSTR and BTC. The fund's NAV is decaying. Premiums are weak. Payouts are funded by slicing off more and more of your own position.

💸The Tax Trap

MSTY's "dividends" are taxable events—even if they're just giving you your own money.

Compare that to simply holding MSTR or BTC:

- • You only pay tax when you sell

- • You keep the upside

- • You avoid the 0.99% management fee for the privilege of being slowly drained

🙃Capped Upside, Uncapped Downside

Let's summarize what you're actually getting with MSTY:

- • Cap your upside

- • Keep full downside

- • Pay taxes and fees for synthetic "yield"

- • Watch NAV bleed while feeling good about "income"

So Who Buys This?

- 1. Yield chasers who don't understand derivatives

- 2. "Passive income" seekers who don't read the fine print

- 3. Retail bagholders who think 90% APY is just Wall Street magic

✅Smarter Alternatives

- • Want MSTR exposure? Buy MSTR

- • Want BTC upside? Buy BTC

- • Want real yield with no games? Buy T-bills

MSTY is a lesson in financial alchemy: it turns your capital into "income" and charges you for the transformation. If you're serious about building wealth, look past the headline yield. The emperor has no yield.

YieldMax UCITS ETF

Score: 4.8- •Official MSTY provider in Europe

- •UCITS fund structure for EU investors

- •Monthly income distributions

- •Professional management

Fees: Management fee: 0.99%

Minimum Deposit: Check with your local broker

European Brokers

Score: 4.5- •Access through local European brokers

- •EU regulated trading environment

- •Local customer support

- •Familiar trading platforms

Fees: Varies by broker

Minimum Deposit: Varies by broker

How to Trade MSTY in Europe

Frequently Asked Questions

Our strategy combines Bitcoin self-custody (80%) with strategic positions in MSTY (10%) for monthly income and MSTR (10%) for additional Bitcoin exposure. MSTY generates income through an options-based strategy on MSTR stock, utilizing covered call writing and put option selling, while also holding short-term U.S. Treasuries as collateral. This approach provides both wealth preservation and regular income without compromising your core Bitcoin position.